Companies typically favour a lower average collection period because it means there’s a shorter time between converting your average balance from accounts receivable to cash. Also, keep in mind that the average collection period only tells part of the story. To really understand your accounts receivables, you need to look at this metric in tandem with related metrics like AR turnover, AR aging, days payable outstanding (DPO), and more. A company’s average collection period gives an insight into its AR health, credit terms, and cash flow. Without tracking the ACP, it will become difficult for businesses to plan for future expenses and projects.

Grow Your Business with QuickBooks

Fashion retailers, in particular, tend to have shorter collection periods due to the seasonal nature of their products and high turnover rates. In conclusion, understanding the importance of Average Collection Period in managing credit terms and customer relationships is crucial for businesses seeking long-term growth and success. By analyzing industry trends, setting appropriate credit policies, and adapting to external factors, organizations can effectively balance efficiency, profitability, and customer satisfaction.

- That said, whatever timeframe you choose for your calculation, make sure the period is consistent for both the average collection period and your net credit sales, or the numbers will be off.

- If you have difficulty collecting customer payments, it’s tough to pay employees, make loan payments, and take care of other bills.

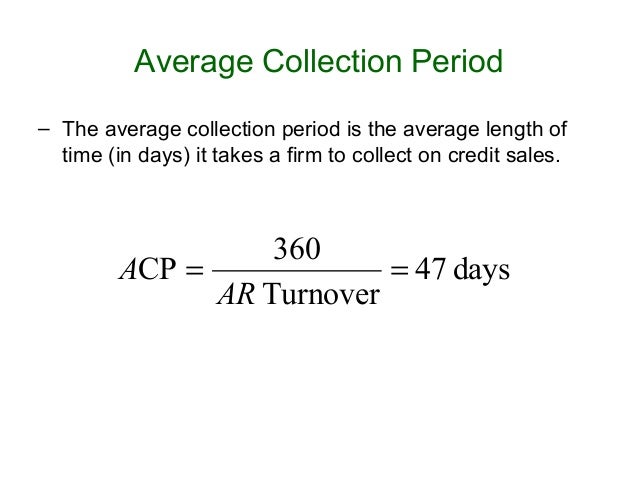

- The Average Collection Period (ACP) is a financial metric that measures how long, on average, it takes for a company to collect payment from its customers after a sale.

How to calculate your average collection period: formula and example

For instance, consumers and businesses often face financial constraints during recessions or economic instability. Consequently, this may delay payments or lead to higher defaults on invoices — resulting in longer average collection periods as companies struggle to collect on outstanding receivables. Law firms, for example, reportedly saw an overall increase of 5% in the average collection cycle in 2023.

Analyzing Credit Terms

Businesses aim for a lower average collection period to ensure they have enough cash to cover their expenses. It is essential for organizations to consistently monitor their average collection period and adapt their credit policies accordingly. By doing so, businesses can respond to industry trends, customer preferences, and economic conditions that may impact their receivables management practices. Regularly reviewing the average collection period enables companies to make informed decisions, optimize their collections processes, and maintain a positive relationship with their clients.

Even though a lower average collection period indicates faster payment collections, it isn’t always favorable. If customers feel that your credit terms are a bit too restrictive for their needs, it may impact your sales. For example, financial institutions, i.e., banks, rely on accounts receivable because they offer their customers credit loans, installments, and mortgages.

Tips for Effective Use of an ACP Calculator

There are many reasons a business owner may want to understand the average collection period meaning, calculation, and analysis. Not only does the ACP value provide important insights into the company’s short-term liquidity and the efficiency of its collection processes, but it can even be used to catch early signs of bad allowances. Most importantly, the ACP is not difficult to calculate, with all the necessary information readily available on a company’s balance sheet and income statement. Efficient management can be achieved by regularly monitoring the accounts receivable collection period. Businesses can spot any payment issues quickly and take action to improve the situation, improving their total net sales and ability to manage accounts receivable balances. With Mosaic you can automatically track your average collection period or days sales outstanding metric to see if your customers are paying according to your benchmarks.

🔎 You can also enter your terms of credit in our calculator to compare them with your average collection period. Although cash on hand is important to every business, some rely more on their cash flow than others. The average collection period is often not an externally required figure to be reported. The usefulness of average collection period is to inform management of its operations. In addition to being limited to only credit sales, net credit sales exclude residual transactions that impact and often reduce sales amounts.

In most cases, a lower average collection period is generally better for business as it indicates faster cash turnover, which improves liquidity and reduces credit risk. However, if the shorter collection period is due to overly aggressive collection practices, it runs the what is and how does an accounting department structure work risk of straining customer relationships, potentially leading to lost business. Industries such as banking (specifically, lending) and real estate construction usually aim for a shorter average collection period as their cash flow relies heavily on accounts receivables.

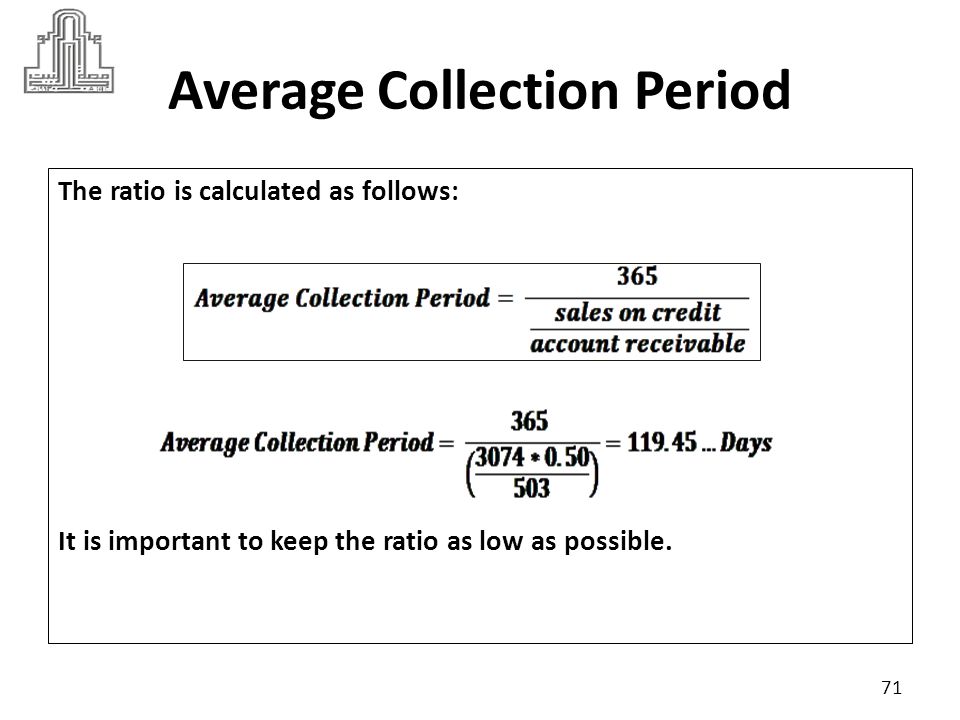

The average collection period is the time a company takes to convert its credit sales (accounts receivables) into cash. It provides liquidity to the company to meet its short-term needs or current expenses as and when they become due. Or multiply your annual accounts receivable balance by 365 and divide it by your annual net credit sales to calculate your average collection period in days for the entire year.