It is important to note that it takes a few days for the bank to clear the cheques. This is especially common in cases where the cheque is deposited at a different bank branch than the one at which your account is maintained, which can lead to the difference international student services between the balances. NSF (Not Sufficient Funds) checks that have been dishonored by a bank due to insufficient funds in the issuer’s bank account. After all adjustments, the ending balance of the cash book should equal the bank statement.

Adjusting the Bank Statement Balance

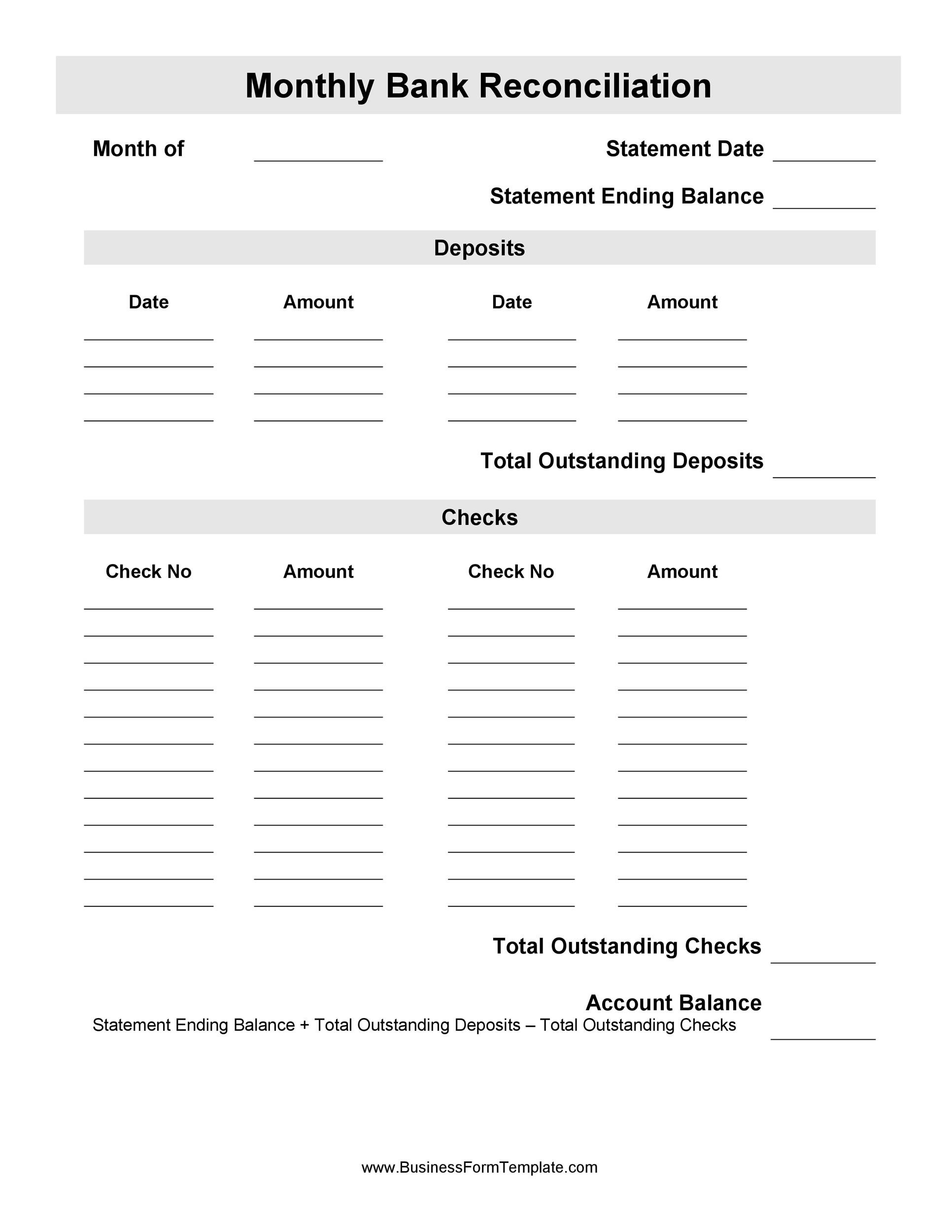

It is up to you, the customer, to reconcile the cash book with the bank statement and report any errors to the bank. As a result, you’ll need to deduct the amount of these cheques from the balance. Once you complete the bank reconciliation statement at the end of the month, you need to print a bank reconciliation report and keep it in your monthly journal entries as a separate document. This document will make auditors aware of the reconciled information at a later date.

Ensures Financial Accuracy and Cash Flow

- The usual procedure calls for the bank to send the depositor not only the notification but also the check itself.

- However, there can be situations where your business has overdrafts at the bank, which is when a bank account goes into the negative as a result of excess withdrawals.

- To do this, businesses need to take into account bank charges, NSF checks, and errors in accounting.

- The firm’s account may contain a debit entry for a deposit that was not received by the bank prior to the statement date.

Theoretically, the transactions listed on a business’ bank statement should be identical to those that appear in the accounting records of the business, with matching ending cash balances on any given day. Doing bank reconciliations regularly helps companies control their financial transactions and easily track errors and omissions. A bank reconciliation statement should be completed monthly but can even be done weekly if your company processes a large number of transactions.

Step 1 – Find the deposits in transit:

Examples include deposited checks returned for non-sufficient funds (NSF) or notes collected on the depositor’s behalf. Reconciling your bank statements won’t stop fraud, but it will let you know when it’s happened. After including all the amounts identified in Step 3, your statements should display the same final balance. If any discrepancies cannot be identified and reconciled, it may signal an error or risk of fraud which your company can investigate further. Errors in the cash account result in an incorrect amount being entered or an amount being omitted from the records.

This statement should itemize every discrepancy, showing the date, amount, and reason for each adjustment. Proper documentation ensures that you maintain a clear record for future reference and auditing purposes. That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions. Here are two examples to reinforce the bank’s use of debit and credit with regards to its customers’ checking accounts. Do you want to test your knowledge about bank reconciliation statement? (c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book.

Compare your bank statements

And if you’re consistently seeing a discrepancy in accounts receivable between your balance sheet and your bank, you know you have a deeper issue to fix. If there’s a discrepancy between your accounts and the bank’s records that you can’t explain any other way, it may be time to speak to someone at the bank. In huge companies with full-time accountants, there’s always someone checking to make sure every number checks out, and that the books match reality. In a small business, that responsibility usually falls to the owner (or a bookkeeper, if you hire one. If you don’t have a bookkeeper, check out Bench).

Similarly, if a businessman deposits any checks on the last day of the month, these cheques may be collected by his bank and shown on his bank statement three or four days later. The need and importance of a bank reconciliation statement are due to several factors. First, bank reconciliation statements provide a mechanism of internal control over cash.

So the company’s accountant prepares an entry increasing the cash currently shown in the financial records. After adjustments are made, the book balance should equal the ending balance of the bank account. Begin with a side-by-side comparison of your bank account statement and your company’s accounting records. Check that your financial transaction records include all payments and deposits for the transaction period, as well as the final balance. You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows).

Checks may be returned for several reasons, such as insufficient funds (NSF), a closed account, or a stop payment order placed by the issuer. You can earn our Bank Reconciliation Certificate of Achievement when you join PRO Plus. To help you master this topic and earn your certificate, you will also receive lifetime access to our premium bank reconciliation materials.